As the market experiences a persistent decline, the Goblin has incurred a loss in value compared to its peak but continues to demonstrate resilience when measured against its benchmark, the Nasdaq, tracked via the QQQ ETF. Furthermore, the Sage, now operational, is expected to diligently pursue its performance objectives, and with the passage of time, we anticipate that it will consistently outperform its benchmark. Notably, we’ve introduced a new benchmark, GVIP, which utilizes a similar methodology, clearly exemplifying our commitment to showcasing our competitive edge and our objective to consistently outperform in the market.

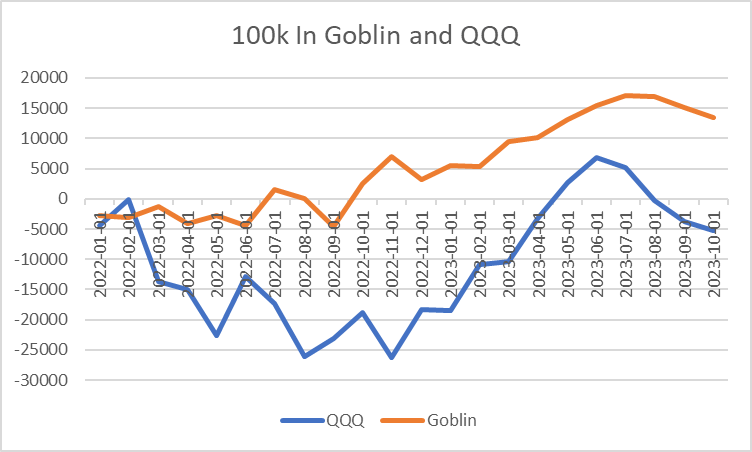

To provide a visual representation of our journey, we’ve included a performance graph below. This graph illustrates the performance of the Goblin compared to its benchmark since its inception in January 2022. As you can see, the Goblin has consistently outperformed its benchmark, exemplifying our commitment to delivering superior results.

Our dedication to ‘Continuous Improvement’ remains unwavering, and despite the demanding nature of our full-time research roles elsewhere, we persist in dedicating time and effort to this endeavor. This underscores our steadfast commitment to the core values that underpin our quant trading activities. As we continue to refine our website, we appreciate your ongoing support on this journey.

Sincerely, Sterling Group

Leave a comment