I am pleased to present our monthly commentary for March 2024, encapsulating the latest developments and strategic insights for Sterling Alpha Group.

At Sterling Alpha Group, we are currently engrossed in a fascinating quandary as we continue to refine our new statistical arbitrage method. Our results appear exceptionally promising, and in our rigorous pursuit of excellence, we persist in our unit testing. As is characteristic of any discerning Quant manager, we maintain a healthy skepticism of our results, yet to date, we have not identified any errors. If all progresses smoothly, we will advance to the walk-forward trials. This phase is not with the expectation of uncovering errors but to cement our utmost confidence in our methodologies. Our commitment to transparency and excellence is further demonstrated as we prepare to test and open-source our performance system, viewable at Portfolio Performance (portfolio-performance.info). While we have developed our own system, we are keen to engage with and contribute to the open-source community. The challenge lies in assessing whether such a product can effectively manage strategies, particularly in integration with a broker that views a global portfolio rather than discrete strategies.

Concerning Gamma Goblin and the QQQ index, they are exhibiting a convergence trend. Despite this, our fund has maintained a commendable outperformance against the QQQ, boasting an 11% lead over an approximate 2.5-year horizon. This success reinforces our focus on strategies that minimise drawdowns, a principle that has become increasingly central to our investment philosophy.

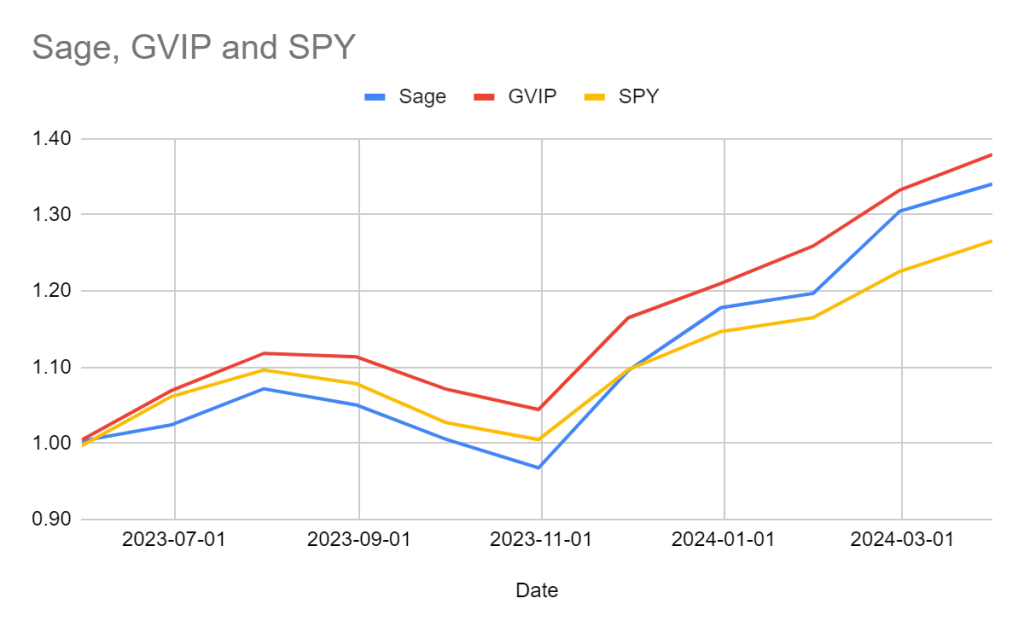

Turning our attention to The Sage, it currently trails one of its benchmarks by roughly 4%. Despite this, The Sage is engaging in a robust performance, and we maintain our conviction that it will ascend to outperform, particularly as it transitions to cash holdings during drawdown periods, as is its strategic design.

In conclusion, our trajectory remains steadfast. We are making significant strides in our R&D endeavours, particularly as we reflect on the transformative potential of the influx of capital into LLM technologies. Our fund is a dedicated proponent of these models, integrating them extensively within our coding practices.

We remain attentive to the evolving landscape and are eager to adapt our strategies to continue delivering superior value to our investors.

Should you have any inquiries or require further clarification on any aspect of this commentary, please do not hesitate to contact us.

Leave a comment