Autumn is here in full swing, and as we prepare for the clocks to turn back, it’s a reminder that time is relative—although Merlin, my cat, steadfastly perched on my desk, remains blissfully unaware. He’s eager to go outside but visibly irritated that it’s still dark, a comical reminder of nature’s own timekeeping as I work away.

On the research front, our focus remains on refining our strategies, most notably the next evolution of Gamma Goblin, now named Gamma Navigator. This updated version is slated to trade on a bond ETF, providing us with a compelling balance by complementing our equity strategy with a fixed-income component. The development continues as we look to identify and iron out any remaining nuances, but early indications are promising.

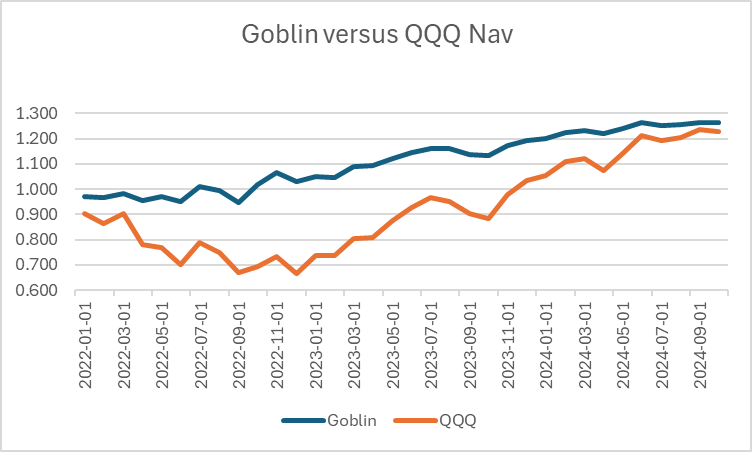

Performance Highlights

In October, Gamma Goblin delivered nearly flat returns, finishing up by a fraction of a percentage point while QQQ closed down approximately 1%. Since its inception in January 2022, Gamma Goblin has outperformed QQQ by 3.59%, consistently delivering value even through challenging market conditions. With a monthly information ratio of 1.04 compared to QQQ’s 0.38, we’re confident in the strategy’s resilience and believe it’s primed for expanded investment and development.

Sage, though operating in a reduced capital mode, posted a respectable 0.5% return this month. In contrast, its benchmarks, GVIP and SPY, returned 0.1% and -0.9%, respectively. Sage’s design incorporates downside protection, but a true test of its capabilities may only arise in a more turbulent market. While our views remain bullish in alignment with broader market sentiments, we acknowledge that Sage’s strengths may best be appreciated under less favourable conditions.

Pushing the Boundaries of Technology

We are continually advancing our understanding and use of large language models (LLMs), exploring how they might integrate into our research and asset allocation efforts. After extensive testing with OpenAI’s recent offerings, I can confidently say that these tools are becoming indispensable. Whether assisting with coding, streamlining research, or enhancing administrative tasks, the productivity boost is undeniable. Imagining a workflow without LLMs would now feel burdensome and inefficient.

As we move forward, the question arises: can these tools meaningfully integrate into our broader asset allocation strategy? While the answer is yet to be fully determined, we are fully committed to this exploration, seeing immense potential.

We even had a LLM review this month’s blog—a testament to their role as invaluable collaborators in enhancing productivity and precision.

Leave a comment