Four years of real-money, tax-audited returns trading the Nasdaq 100. Not backtested. Not paper traded. Actual capital deployed with independently verifiable performance.

Strategy Overview

Sterling Gamma Goblin is a systematic approach to trading the Nasdaq 100 (QQQ). The strategy dynamically adjusts exposure based on market conditions, maintaining an average net long position of approximately 40%.

Core Characteristics:

- Instrument: QQQ ETF

- Average Exposure: ~40% net long

- Approach: Rules-based, systematic rebalancing

- Risk Management: Position sizing designed to limit drawdowns

Philosophy: We prioritise risk-adjusted returns over absolute performance. The strategy accepts underperformance during strong bull markets in exchange for significantly reduced drawdowns and capital preservation.

Why This Track Record Matters

Most quantitative strategies present backtests. Backtests can be optimised, cherry-picked, and overfit to historical data. They prove very little about future performance.

This is different:

48 consecutive months of real trading. Every position taken with actual capital. Every return verified through tax filings and broker statements. No simulation. No optimisation after the fact.

Performance Analysis

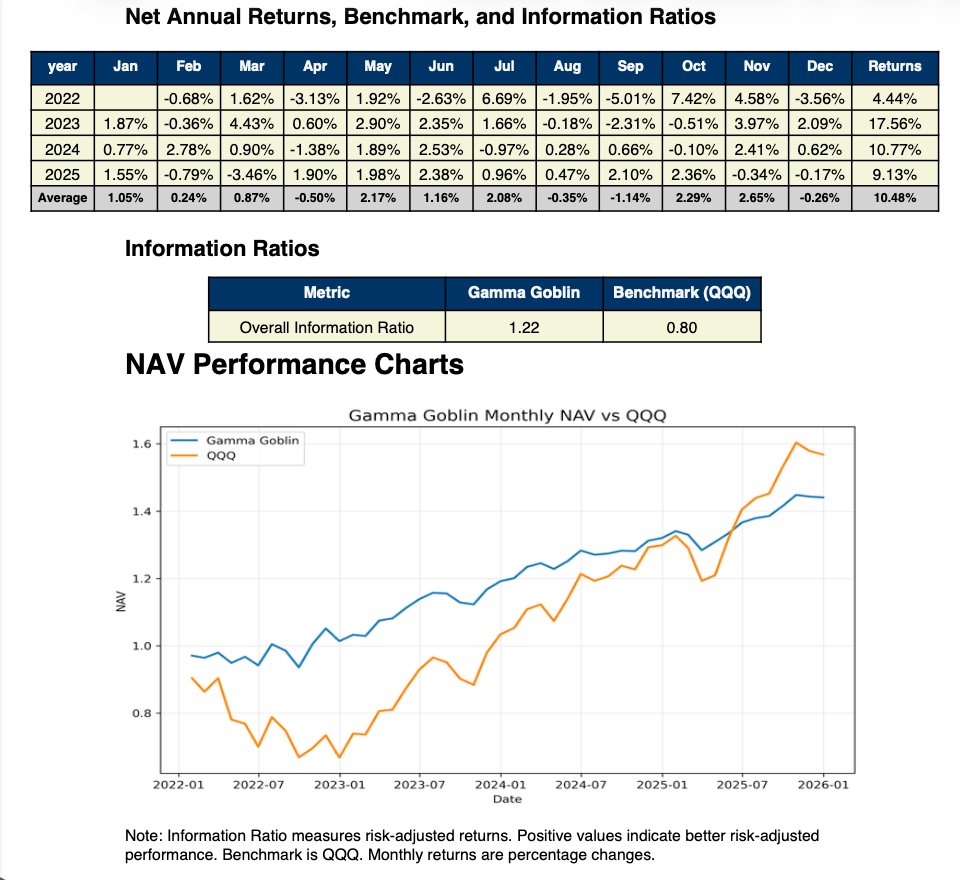

Four-Year Summary (2022-2025):

Over this period, Gamma Goblin:

- Delivered nearly double the Information ratio (1.17 vs 0.64)

- Experienced dramatically lower drawdowns throughout

- Avoided catastrophic “valley of death” periods

The strategy underperformed in absolute terms during a historic bull market. This is by design. The strategy sacrifices some upside participation to protect against significant downside.

Key Insight: In the inevitable market correction, controlled drawdowns become the primary determinant of long-term wealth compounding. A 50% drawdown requires a 100% gain to recover. A 5% drawdown requires only 5.3%.