A Different Starting Point

Most quantitative strategies begin with market data — searching for patterns in prices, correlations between assets, signals in the noise. We took a different path.

We began by studying randomness itself. Fair coin flips. Synthetic noise. Pseudo-random sequences. We developed methods to understand random processes so deeply that we can detect the slightest deviation from pure randomness.

This may sound counterintuitive. But any deviation from randomness — however small — can be harnessed.

The Research

We built simulations. Thousands of them. Casino games with fair coin flips. Continuous random sequences. Synthetic data with precisely known statistical properties. Environments where there is no information, no edge — only pure mathematical randomness.

Our methods detected structure. Not by beating randomness — that is impossible — but by identifying systematic deviations from pure noise.

Only then did we apply these methods to markets.

What We Found

Markets are often described as random. They are not purely random. There are subtle deviations — exploitable structure that our methods were built to detect.

We tested across 23 liquid ETFs spanning equities, fixed income, commodities, and precious metals. Nine years of out-of-sample data. Core methodology developed entirely on synthetic data before market application.

Every instrument was profitable.

Results

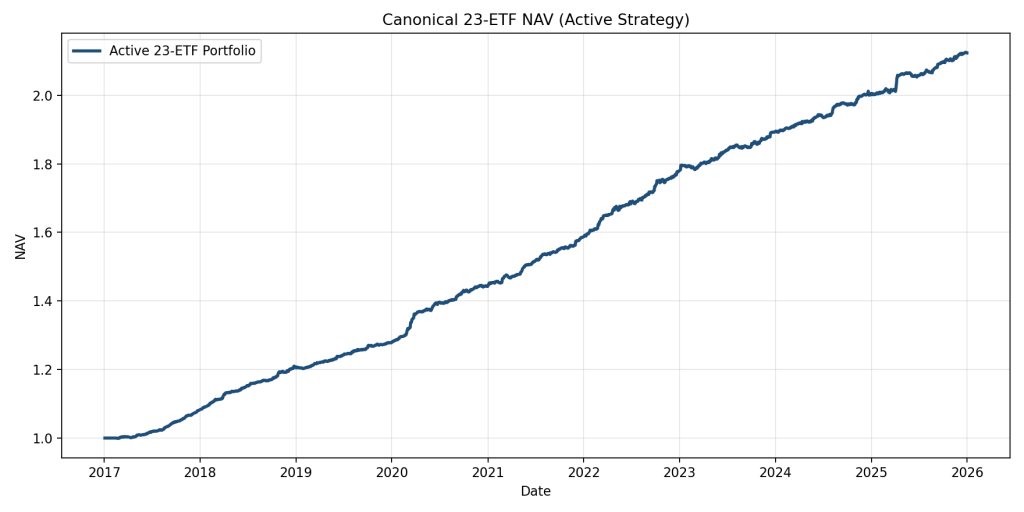

Out-of-sample performance: 23 ETFs, volatility-weighted portfolio, 2017-2025. No leverage applied.

Performance Metrics

Stats (Steeplechase)

- Window: 2017-01-03 to 2025-12-31

- CAGR: 8.7544%

- Sharpe: 5.0185

- Max drawdown: -0.7268%

- Universe: 23 liquid ETFs

- Status: Backtested; walk-forward paper trading in progress

Portfolio Composition

ETFs tested: 23

ETFs profitable: 23

Asset classes: 5

Yes, we know — backtests prove nothing.

We agree. That’s why we didn’t start with markets. We built the methodology on synthetic random processes — fair coin flips, pure noise, environments where overfitting is mathematically impossible.

The edge was proven to exist in pure randomness before we touched a single price. The market backtest above is confirmation, not discovery.

Statistical validation: Hundreds of simulations. Multiple random seeds. P-values below 0.000001.

Why it should persist: The edge is structural — it emerges from mathematics, not from market inefficiency. The structure we exploit is inherent to how volatility behaves. It cannot be arbitraged away.

Engineering Discipline

Every calculation is unit-tested. Over 350 automated tests validate our methodology. This is not a spreadsheet backtest — it is production-grade research infrastructure.

Current Status

Sterling Steeplechase is live, trading our own capital. We welcome conversations with institutional investors, family offices, and research partners who share our commitment to rigorous, mathematically-grounded approaches.

Detailed methodology available under NDA.

Backtested results, in walk forward now to refine and determine how much can be captured.