The Sage, a name so wise and true,

A strategy for those in the know,

Investing smart, reaping profits too,

A path to wealth, with The Sage you'll grow.

We had the opportunity to meet the manager of The Sage, who boasts an impressive track record. Impressed by this track record, we made the decision to invest in the concept, and in May 2023, we started incubation. The Sage is quantitatively managed, with its methodology firmly rooted in the analysis of 13-F statements. This quantitative approach utilises data-driven insights to guide its investment decisions. The strategy is continually optimised through proprietary risk management techniques to minimize risk and maximize returns.

Process

To integrate the use of proprietary intellectual property (IP) in identifying trends and formulating the portfolio and control system, we can merge steps 2 and 3 for clarity. Here’s how you could present it in your blog:

- Scan 13-F Statements: The process starts with a comprehensive review of 13-F filings to discern the investment patterns of informed investors. This involves an in-depth examination of public disclosures to gather data on where the experienced money is moving.

- Apply Proprietary Intellectual Property to Identify and Analyse Trends: Utilising our unique intellectual property, we delve into the data to identify and analyse smart money trends. Our IP serves as a sophisticated filter to enhance our understanding of these trends and to develop strategies that capitalise on this analysis.

- Formulate Portfolio Using Insights Gained from Proprietary Analysis: Armed with these insights, we craft a portfolio that is not only aligned with strategic investment goals but also stands on the strong foundation of our refined analysis, ensuring a robust selection of investments.

- Implement Control System Informed by Proprietary IP: The portfolio is continuously monitored through a control system that is informed by our proprietary intellectual property.

Benchmark

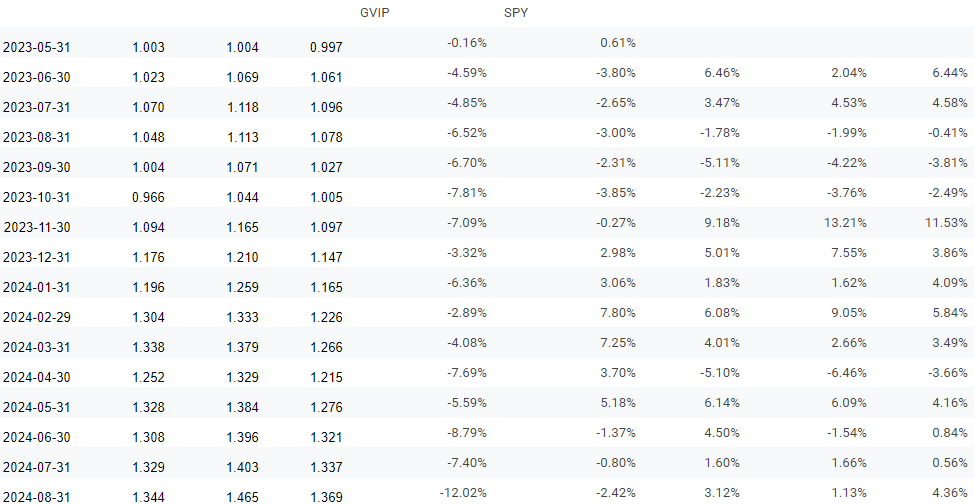

Originally, our benchmark was intended to be the S&P 500, and we will still include it for reference. However, we have discovered another benchmark, GVIP, managed by Goldman Sachs. A notable difference between GVIP and our strategy is their portfolio composition. GVIP maintains 50 positions, whereas we have 20. They use equal weighting, while we focus on risk management. Additionally, we have the flexibility to move into cash positions, whereas GVIP is always fully invested.

Performance since inception